- TAX E FILE EXTENSION 2016 IRS SOFTWARE

- TAX E FILE EXTENSION 2016 IRS PASSWORD

- TAX E FILE EXTENSION 2016 IRS FREE

TAX E FILE EXTENSION 2016 IRS SOFTWARE

If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge.Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Emerald Cash Rewards TM are credited on a monthly basis.H&R Block is a registered trademark of HRB Innovations, Inc.All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

TAX E FILE EXTENSION 2016 IRS FREE

Additional terms and restrictions apply See Free In-person Audit Support for complete details.

It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state).Standard live chat hours apply (10:00 a.m. You can ask our tax advisors an unlimited number of questions at no extra cost (excludes business returns).

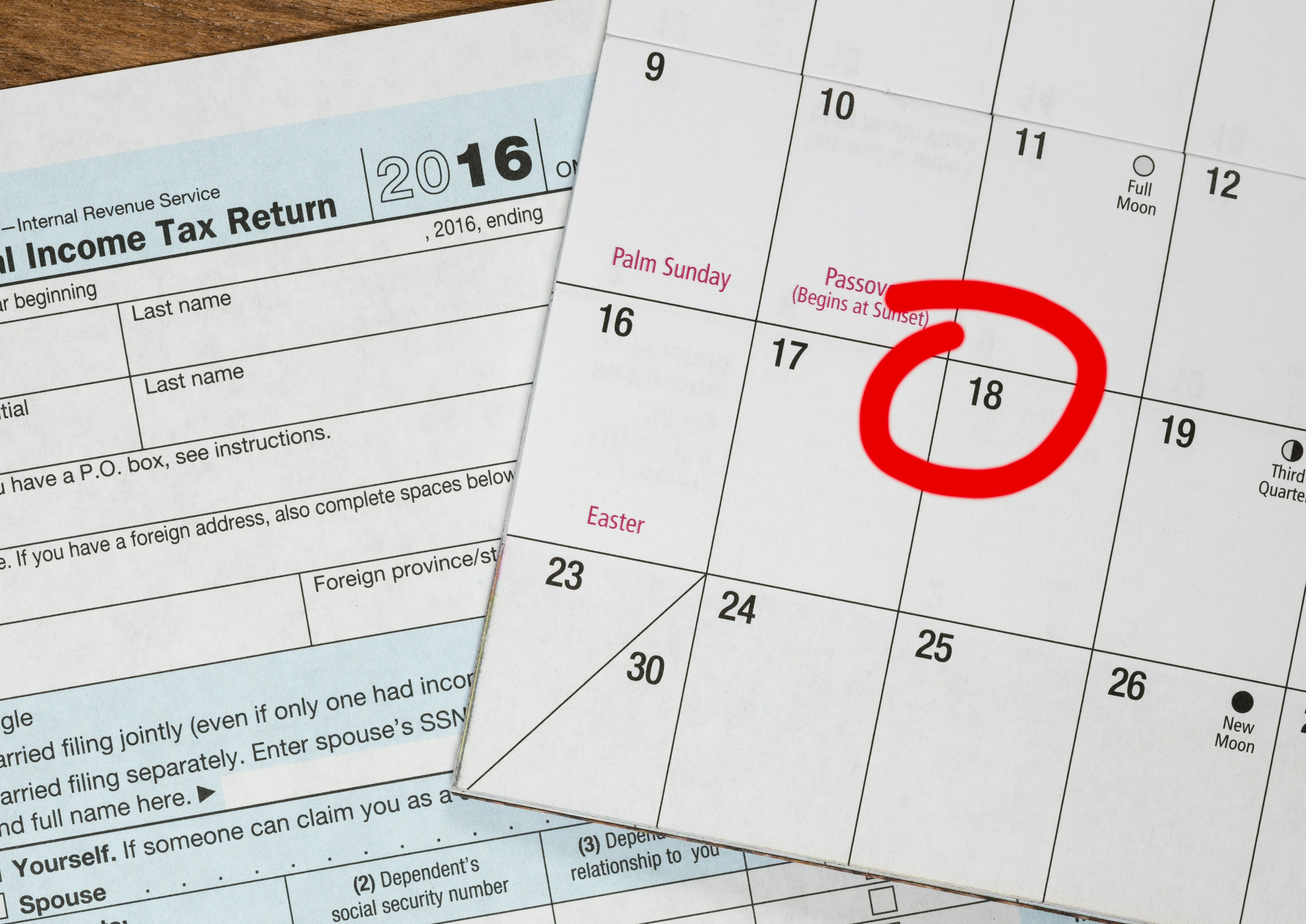

H&R Block Online Deluxe or Premium, or H&R Block Software Basic, Deluxe, Premium or Premium & Business get unlimited sessions of live, personal tax advice with a tax professional.15 extension deadline to avoid any penalties. Be sure to complete your filing on or before the Oct. The H&R Block Online product will guide you through an interview, which we’ll use to complete your tax forms.

/cloudfront-us-east-1.images.arcpublishing.com/gray/LLBZH2UPP5GY3KRSCSQCYVIW6Q.jpg)

TAX E FILE EXTENSION 2016 IRS PASSWORD

Simply log in to your MyBlock account using the same username and password that you created to e-file your tax extension. You can finish your return at any time during the next six months. The IRS will process your authorized payment within a two-day period. If you’re not able to correct the errors, you’ll need to file a paper extension Form 4868 and include an estimated payment of your taxes due. Then you can electronically retransmit your Form 4868. The silver lining of this rejection is that you might have a chance to change your debit amount.įirst, you’ll need to see if you can correct the errors. On occasion, an IRS extension request can be rejected if it happened to contain errors. However, there is one way that you might get the opportunity to change the amount. IRS Extension Request Rejection May Give You a Chance to Change the Amount If you used an H&R Block Online product to transmit and e-file your extension, you might be wondering if you can change your authorized debit amount later. At the time you request your extension, you’ll need to pay any taxes due. When you e-file your extension, you automatically get an additional six months to complete your return.

0 kommentar(er)

0 kommentar(er)